終値に誤り発見!Power Law:(33)を参照。再トライ,TODO)

Mistakes to the closing share price!Refer to Power Law:(33). Re-trial and TODO)

http://humanbeing-etcman.blogspot.com/2008/12/power-law33stocklast-price-incorrect.html

(2008/11/23-2008/11/27)

新聞の株式欄を見る。

東証第1部の食品関係の会社で、終値のべき乗傾向の推移をチェックする。

期間:2008/11/07, 2008/11/14, 2008/11/17 ~ 2008/11/21

The stocks column of the newspaper is seen.

The transition of the Power Law tendency to Last price is checked in the company related to the food of first section of the Tokyo Stock Exchange.

Period: 2008/11/07, 2008/11/14, 2008/11/17 to 2008/11/21

データはサイトにありそうだが、とりあえず、Excelに打ち込んだ。

It input it to Excel though data seemed to be on the site.

データは以下を使用。

Data is used as follows.

http://humanbeing-etcman.blogspot.com/2008/12/stock4tsefoodslast-price200811xx.html

~~~

方法,Method)

[1]日単位で、終値の順位のべき乗傾向をチェックする。

:両対数グラフをExcelで作成する(y軸を終値にする。x軸を順位(降順)とする)。

[1]The Power Law tendency to the order of Last price is checked every day.

:Both logarithm graph is made by Excel. (y axis is made a last price.

x axis is assumed to be an order (descending order). )。

[2]一位から近似直線の最適値までの順位をべき乗範囲とする。

[2]The order from the 1st place to the optimal value of the approximation straight line is made the range of the Power Law.

[3]べき乗範囲でのA,B値を得る。

[3]A and B value in the range of the Power Law are obtained.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

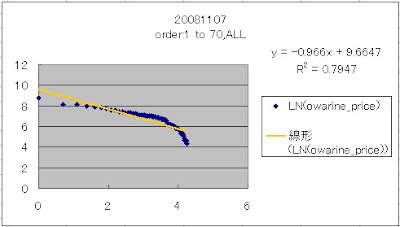

[20081107]

[1] 20081107,Company=order:1 to 70,ALL

LN(y) = -0.966*LN(x) + 9.6647, R^2=0.7947

---

[2] 20081107,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.9576

order:1 to 20 R^2=0.9817

order:1 to 25 R^2=0.986

order:1 to 29 R^2=0.988

order:1 to 30 R^2=0.9885

order:1 to 31 R^2=0.9888

order:1 to 32 R^2=0.9891

order:1 to 33 R^2=0.9895 <--:best

order:1 to 34 R^2=0.9889

order:1 to 35 R^2=0.9883

order:1 to 40 R^2=0.9694

order:1 to 50 R^2=0.904

order:1 to 60 R^2=0.8634

order:1 to 70 R^2=0.7947

---

[3] 20081107,Company=order:1 to 33

LN(y) = -0.535*LN(x) + 8.7058 , R^2=0.9895

LN

(x, y)=(1, exp(8.7058)),(33, exp(-0.535*LN(33) + 8.7058))

=(1, 6037.83),(33, 929.98)

Relative value)

=(1, 6037.83/929.98),(33, 1)

=(1, 6.492),(33, 1)

A=-0.535

B=6.492

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

[20081114]

[1] 20081114,Company=order:1 to 70,ALL

LN(y) = -0.9646*LN(x) + 9.6387 , R^2=0.7874

---

[2] 20081114,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.953

order:1 to 20 R^2=0.9797

order:1 to 25 R^2=0.9846

order:1 to 29 R^2=0.9871

order:1 to 30 R^2=0.9876

order:1 to 31 R^2=0.9881

order:1 to 32 R^2=0.9885

order:1 to 33 R^2=0.9887 <--:best

order:1 to 34 R^2=0.9883

order:1 to 35 R^2=0.9878

order:1 to 40 R^2=0.9718

order:1 to 50 R^2=0.906

order:1 to 60 R^2=0.8607

order:1 to 70 R^2=0.7874

---

[3] 20081114,Company=order:1 to 33

LN(y) = -0.5296*LN(x) + 8.6693 , R^2=0.9887

LN

(x, y)=(1, exp(8.6693)),(33, exp(-0.5296*LN(33) + 8.6693))

=(1, 5821.42),(33, 913.74)

Relative value)

=(1, 5821.42/913.74),(33, 1)

=(1, 6.371),(33, 1)

A=-0.5296

B=6.371

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

[20081117]

[1] 20081117,Company=order:1 to 70,ALL

LN(y) = -0.9639*LN(x) + 9.6413 , R^2=0.7872

---

[2] 20081117,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.9677

order:1 to 20 R^2=0.9852

order:1 to 25 R^2=0.9885

order:1 to 29 R^2=0.9904

order:1 to 30 R^2=0.9908

order:1 to 31 R^2=0.9911

order:1 to 32 R^2=0.9914

order:1 to 33 R^2=0.9915 <--:best

order:1 to 34 R^2=0.9912

order:1 to 35 R^2=0.9909

order:1 to 36 R^2=0.9888

order:1 to 40 R^2=0.9755

order:1 to 50 R^2=0.9098

order:1 to 60 R^2=0.8624

order:1 to 70 R^2=0.7872

---

[3] 20081117,Company=order:1 to 33

LN(y) = -0.53*LN(x) + 8.6739, R^2=0.9915

LN

(x, y)=(1, exp(8.6739)),(33, exp(-0.53*LN(33) + 8.6739))

=(1, 5848.26),(33, 916.67)

Relative value)

=(1, 5848.26/916.67),(33, 1)

=(1, 6.38),(33, 1)

A=-0.53

B=6.38

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

[20081118]

[1] 20081118,Company=order:1 to 70,ALL

LN(y) = -0.9638*LN(x) + 9.641 , R^2=0.7844

---

[2] 20081118,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.9698

order:1 to 20 R^2=0.9829

order:1 to 28 R^2=0.9884

order:1 to 29 R^2=0.9888

order:1 to 30 R^2=0.9892

order:1 to 31 R^2=0.9897

order:1 to 32 R^2=0.99 <--:best

order:1 to 33 R^2=0.9899

order:1 to 34 R^2=0.9896

order:1 to 35 R^2=0.9895

order:1 to 36 R^2=0.9873

order:1 to 37 R^2=0.9858

order:1 to 40 R^2=0.9741

order:1 to 50 R^2=0.9094

order:1 to 60 R^2=0.8617

order:1 to 70 R^2=0.7844

---

[3] 20081118,Company=order:1 to 32

LN(y) = -0.525*LN(x) + 8.6634 , R^2=0.99

LN

(x, y)=(1, exp(8.6634)),(32, exp(-0.525*LN(32) + 8.6634))

=(1, 5787.18),(32, 938.13)

Relative value)

=(1, 5787.18/938.13),(32, 1)

=(1, 6.169),(32, 1)

A=-0.525

B=6.169

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

[20081119]

[1] 20081119,Company=order:1 to 70,ALL

LN(y) = -0.965*LN(x) + 9.6474 , R^2=0.782

---

[2] 20081119,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.9734

order:1 to 20 R^2=0.9805

order:1 to 30 R^2=0.9882

order:1 to 31 R^2=0.9887

order:1 to 32 R^2=0.9891 <--:best

order:1 to 33 R^2=0.9887

order:1 to 34 R^2=0.9885

order:1 to 35 R^2=0.9886

order:1 to 36 R^2=0.9866

order:1 to 37 R^2=0.9854

order:1 to 40 R^2=0.9746

order:1 to 45 R^2=0.9365

order:1 to 50 R^2=0.9089

order:1 to 60 R^2=0.8598

order:1 to 70 R^2=0.782

---

[3] 20081119,Company=order:1 to 32

LN(y) = -0.524*LN(x) + 8.664 , R^2=0.9891

LN

(x, y)=(1, exp(8.664)),(32, exp(-0.524*LN(32) + 8.664))

=(1, 5790.65),(32, 941.95)

Relative value)

=(1, 5790.65/941.95),(32, 1)

=(1, 6.148),(32, 1)

A=-0.524

B=6.148

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

[20081120]

[1] 20081120,Company=order:1 to 70,ALL

LN(y) = -0.9729*LN(x) + 9.6451 , R^2=0.7824

---

[2] 20081120,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.9726

order:1 to 20 R^2=0.9799

order:1 to 25 R^2=0.9847

order:1 to 29 R^2=0.9872

order:1 to 30 R^2=0.9877

order:1 to 31 R^2=0.9882

order:1 to 32 R^2=0.9885

order:1 to 33 R^2=0.9884

order:1 to 34 R^2=0.9884

order:1 to 35 R^2=0.9886 <--:best

order:1 to 36 R^2=0.9874

order:1 to 37 R^2=0.986

order:1 to 38 R^2=0.9847

order:1 to 40 R^2=0.9758

order:1 to 50 R^2=0.9037

order:1 to 60 R^2=0.8618

order:1 to 70 R^2=0.7824

---

[3] 20081120,Company=order:1 to 35

LN(y) = -0.537*LN(x) + 8.6704 , R^2=0.9886

LN

(x, y)=(1, exp(8.6704)),(35, exp(-0.537*LN(35) + 8.6704))

=(1, 5827.83),(35, 863.66)

Relative value)

=(1, 5827.83/863.66),(35, 1)

=(1, 6.748),(35, 1)

A=-0.537

B=6.748

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

[20081121]

[1] 20081121,Company=order:1 to 70,ALL

LN(y) = -0.9776*LN(x) + 9.6639 , R^2=0.7845

---

[2] 20081121,Company=order:1 to xxx

R^2 is checked.

order:1 to 10 R^2=0.9575

order:1 to 20 R^2=0.9686

order:1 to 30 R^2=0.9809

order:1 to 33 R^2=0.9825

order:1 to 34 R^2=0.9829

order:1 to 35 R^2=0.9832 <--:best

order:1 to 36 R^2=0.9824

order:1 to 37 R^2=0.9818

order:1 to 40 R^2=0.9729

order:1 to 45 R^2=0.9299

order:1 to 50 R^2=0.9

order:1 to 60 R^2=0.8625

order:1 to 70 R^2=0.7845

---

[3] 20081121,Company=order:1 to 35

LN(y) = -0.5426*LN(x) + 8.6911 , R^2=0.9832

LN

(x, y)=(1, exp(8.6911)),(35, exp(-0.5426*LN(35) + 8.6911))

=(1, 5949.72),(35, 864.34)

Relative value)

=(1, 5949.72/864.34),(35, 1)

=(1, 6.884),(35, 1)

A=-0.5426

B=6.884

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

A-Bをグラフに出力。

A-B is output to the graph.

---

ファイル:powerlaw-xx-a-b.txt を使用。The file: Powerlaw-xx-a-b.txt is used.

===

A,B,date,order,lab_disp

-0.535,6.492,20081107,33,right

-0.5296,6.371,20081114,33,left

-0.53,6.38,20081117,33,right

-0.525,6.169,20081118,32,right

-0.524,6.148,20081119,32,left

-0.537,6.748,20081120,35,right

-0.5426,6.884,20081121,35,right

===

---

Rのコードは以下。The code of R is the following.

data_ab = read.csv("powerlaw-xx-a-b.txt");

plot(log(abs(data_ab$A[0])), log(data_ab$B[0]), xlab="log(abs(a))", ylab="log(b)", xlim=c(-0.7, -0.5), ylim=c(1.6, 2.2),

col="orange", pch=20, main="Scatter chart:a-b, Power Law(xx),Foods")

par(new=T)

#

for (i in 1:length(data_ab$A)){

plot(log(abs(data_ab$A[i])), log(data_ab$B[i]), xlim=c(-0.7, -0.5), ylim=c(1.6, 2.2), ann=F)

if (data_ab$lab_disp[i] == "right"){

text(log(abs(data_ab$A[i])), log(data_ab$B[i]), data_ab$date[i], cex=0.75, pos=4, offset=0.5)

}

else if (data_ab$lab_disp[i] == "left"){

text(log(abs(data_ab$A[i])), log(data_ab$B[i]), data_ab$date[i], cex=0.75, pos=2, offset=0.5)

}

else{

text(log(abs(data_ab$A[i])), log(data_ab$B[i]), data_ab$date[i], cex=0.75, pos=4, offset=0.5)

}

par(new=T)

}

abline(v = log(0.6), col="red")

abline(log(144), 5, col="gray", lty=2)

~~~

図から傾き=5以外の可能性がありそうだ。

There seem to be possibilities other than inclination =5 from figure.

ライン:a2,a3,a4,a5 の式を求めてみる。

The line: The expression of a2, a3, a4, and a5 is obtained.

y = ax + b

a = (y2 - y1)/(x2 - x1)

b = y1 - ax1

---

(line:a2)

a = (2.13 - 1.63)/(-0.55 + 0.7) = 3.33

b = 1.63 - 3.33*(-0.7) = 3.961

y = 3.33 * x + 3.961

y = 3.33 * x + LN(52.51)

---

(line:a3)

a = (2.15 - 1.755)/(-0.5 + 0.7) = 1.975

b = 1.755 - 1.975*(-0.7) = 3.1375

y = 1.975 * x + 3.1375

y = 1.975 * x + LN(23.046)

---

(line:a4)

a = (2.12 - 1.725)/(-0.5 + 0.7) = 1.975

b = 1.725 - 1.975*(-0.7) = 3.1075

y = 1.975 * x + 3.1075

y = 1.975 * x + LN(22.365)

---

(line:a5)

a = (2.11 - 1.713)/(-0.5 + 0.7) = 1.985

b = 1.713 - 1.985*(-0.7) = 3.1025

y = 1.985 * x + 3.1025

y = 1.985 * x + LN(22.2535)

~~~

ライン(a2,a3,a4,a5) をablineで表現すると以下になる。

When line (a2,a3,a4,a5) is expressed with abline, it becomes it as follows.

#line:a2, y = 3.33 * x + LN(52.51)

abline(log(52.51), 3.33, col="gray", lty=2)

#line:a3, y = 1.975 * x + LN(23.046)

abline(log(23.046), 1.975, col="gray", lty=2)

#line:a4, y = 1.975 * x + LN(22.365)

abline(log(22.365), 1.975, col="gray", lty=2)

#line:a5, y = 1.985 * x + LN(22.2535)

abline(log(22.2535), 1.985, col="gray", lty=2)

~~~

[図への考察,Consideration to figure]

FnまたはLnへに収束することで安定化する。

市場規模が拡大することで安定する。B値がアップ。

It stabilizes by settling Fn or Ln.

The market scale expands and it stabilizes. B value improves.

~~~

end

0 件のコメント:

コメントを投稿